What we can all learn from Private Equity about talent - McKinsey, HBR and our analysis

Private Equity has become one of the most influential forces in business, outperforming public companies through disciplined value creation and exceptional talent strategy. This article explains how PE achieves its results and why demand for ex-consulting talent is rising across the industry.

Table of contents

Tags

Subscribe to our Newsletter

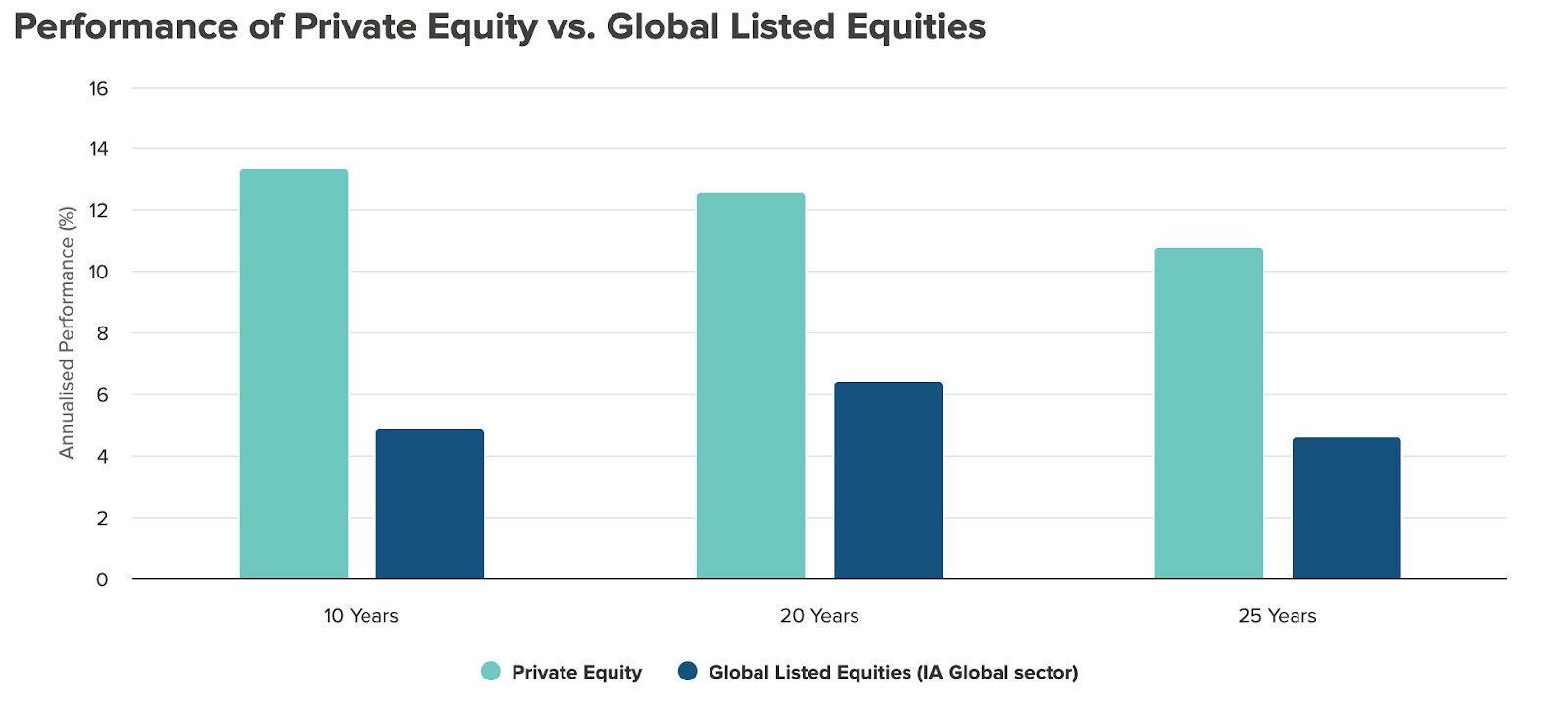

Private Equity companies achieve productivity gains of 8% to 12% in the first two years after their acquisition, far outpacing the 2% to 4% gains that public companies typically see. In this article, we explore the growth of Private Equity as an industry, unpack how these firms achieve such outsized productivity improvements, and deep-dive into the increasingly critical role that ex-consulting talent plays in driving these transformations.

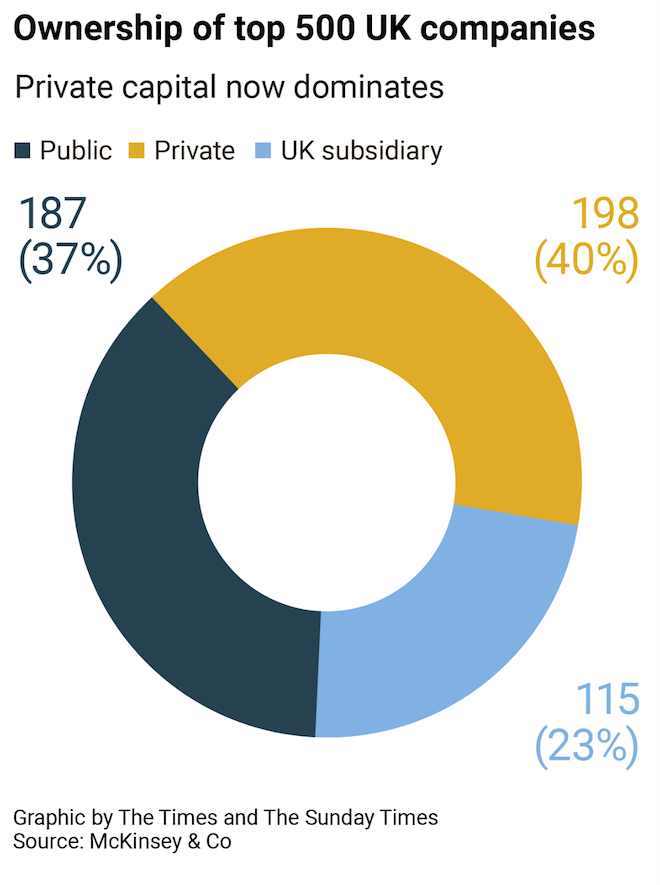

Today, Private Equity owns more of the UK’s largest companies than the public markets do

Private Equity has historically been seen as a niche sector - an alternative ownership structure which has attracted considerable media attention. But this characterisation no longer reflects reality. Over the last two decades, outsized returns have resulted in huge amounts of capital flowing into Private Equity.

This has seen LPs (investors who contribute capital but do not actively manage the company - typically pension funds, insurance companies, etc.) increase their target allocation to PE from just 6% to over 8%. The result is a significant rise in PE-owned businesses. Of the UK’s largest 500 companies, McKinsey’s analysis shows that more are Private Equity-owned than publicly traded.

The Private Equity model has fundamentally changed

The Private Equity model has also fundamentally evolved. When interest rates were low, the cost of financing leveraged buyouts was extremely low. So funds were able to buy companies, increase the amount of debt at a very low cost, and get the added benefit of offsetting the cost of debt against taxation.

As interest rates have gone from sub 2% to 5%, the economics of this model have fundamentally changed. The cost of servicing the debt has more than doubled - putting much more pressure on the other side of the PE model: operational transformation.

Much focus goes on the PE value-creation levers. Typically they’re reflective of traditional commercial and operational transformation levers and are split into:

Top-line (impacting revenue):

- Commercial effectiveness (pricing, marketing, sales excellence)

- Technology (ERP)

- New markets / new products

Bottom-line (impacting cost):

- Operational effectiveness (lean, ops transformation)

- Cost-out (org design, target operating model)

- Procurement

And Private Equity companies have proved they’re very good at driving these changes: HBR found that PE-backed companies achieve productivity gains of 8% to 12% in the first two years after their acquisition - far outpacing the 2% to 4% gains that public companies typically see.

How does Private Equity achieve 8-12% productivity gains

HBR and McKinsey worked with 120 CEOs to analyse what PE-businesses do differently. They boiled it down to 6 main differences:

1. Conduct Full-Potential Due Diligence Continually

PE-backed firms constantly develop a “momentum case” (do nothing) and a “full potential case” (do everything), and continually re-evaluate priorities.

This ensures that decision-making stays aligned with value creation rather than inertia.

2. Build a Fit-for-Purpose Management Team

The CEO and senior team must deeply reflect the company’s value-creation thesis.

PE firms focus intently on securing talent not only in the C-suite but also one to two levels below, where execution truly happens.

3. Clean-Sheet Labour

Implement robust controls for headcount and prioritise building lean, high-performing teams.

In the PE model, talent density matters far more than organisational size.

4. Eliminate Bad Revenue

Regularly analyse revenue streams and cut unprofitable or low-margin lines that consume resources and dilute focus.

PE firms are unusually disciplined here, and it accelerates performance.

5. Execute Relentlessly

Break the firm’s value-creation thesis into 3-8 workstreams, each containing dozens or hundreds of initiatives.

This level of granularity allows early detection of bottlenecks and ensures momentum.

6. Treat Time as Capital

Boards and PE owners encourage CEOs to regularly analyse how they spend their time, ensuring it aligns with the company’s most critical priorities.

Time is treated as a finite, high-value resource, not a passive input.

What role does talent play in this

Central to all six practices is talent.

Ensuring the top 2-3 layers are exceptional and aligned to the value-creation thesis is non-negotiable.

Equally important is the shift from a traditional “talent pyramid” to a “talent density” model: fewer people, higher calibre, faster execution.

So what roles are PE funds hiring ex-consultants for - and why?

1. The key roles - Chief Transformation Officer, Operating Partners and Head of PMO

Private Equity has created some key roles to hold the business, and its Executive Team, accountable for delivery against the Value Creation Plan.

Chief Transformation Officer (CTrO)

A member of the Executive Team, usually part of the Management Incentive Plan, who is responsible for:

- constantly revisiting the strategy

- leading implementation

- holding executives to account

- coaching senior leaders and their teams

- working closely with the Fund to keep alignment tight

Bain analysis found that transformations with a CTrO deliver 24% more impact than those without.

The role has become one of the most important levers for executing high-stakes transformation at pace.

Operating Partner

A fund-level senior role, usually held by an experienced former C-level operator.

Operating Partners typically oversee two portfolio companies and work closely with Boards to ensure:

- the right people are in the right roles

- leaders receive targeted coaching and support

- information flow between the company and the fund is transparent and actionable

They serve as the strategic interface between the Fund and the business and are crucial to maintaining high accountability.

Head of PMO

A dedicated leadership role focused solely on overseeing execution of the Value Creation Plan.

They provide:

- visibility into progress across all initiatives

- structured reporting to the Board

- early identification of blockers and deviations

- the discipline needed to keep dozens (or hundreds) of workstreams moving

The Head of PMO role has grown sharply in importance as transformations become more complex and fast-paced.

2. Leveraging external experts

From the ongoing due diligence and clean sheet labour analyses, there will be regular skillsets and competencies identified that are required to achieve the Value Creation Plan. Private Equity is exceptional at deciding whether these are temporary requirements or ongoing - and for the former, whether an interim or consulting firm is best to achieve impact.

We’ve found a huge growth in our Agile consulting offering - a senior McKinsey, BCG or Bain Partner leading a team of Functionally focused ex-MBB consultants who have deep industry experience. This balance of a Partner overseeing the work alongside a team of real “operators” is driving a huge impact for Funds. Typically at a fraction of the price of traditional consulting offerings.

3. Assessing talent in Private Equity

Experience at a top-tier consulting firm (McKinsey, BCG, Bain etc.) combined with industry experience is considered baseline for these roles. What PE firms look for is the edge that differentiates one high-calibre candidate from another.

The focus is on:

Demonstrated impact

Candidates must show clear ownership of results, not just team or company achievements, but direct, attributable impact driven by their actions.

Unique industry experience

PE values candidates who have seen how others have solved similar problems.

Relevant industry exposure accelerates execution and reduces learning curves.

Functional alignment with the value-creation plan

Just as a CEO must align with the strategy, roles like CTrO or Head of PMO must have spikier strengths where the company is going, not just where it has been.

Private Equity has proven its ability to drive productivity improvements in short-time periods. Whilst the levers are well-known, the role of talent is critical. The playbook around clear roles to drive the Value Creation Plan is one that other companies can learn from - providing leverage and focus for Boards.

At Movemeon, we work with organisations across PE, consulting and high-growth sectors to help them identify, hire and develop the kind of leaders these CEOs described, people who bring breadth, accountability, resilience and real impact from day one. Whether you’re strengthening your senior team, building a succession pipeline or needing immediate execution power through interim talent, our network and expertise give you access to the highest-calibre operators, strategists and future CEOs.

Reference

Harvard Business Review (2025). What Every Company Can Learn from Private Equity.https://hbr.org/2025/11/what-every-company-can-learn-from-private-equity

To find out more about hiring with Movemeon get in touch with our team here.

Where Talent Meets Opportunity

Our exclusive network use us to find job that fit their skills, and thousands of Employers trust us to hire exceptional talent. Choose the path that matches your goals - start exploring or start hiring.

Our latest articles

We regularly publish up-to-date articles to keep you up-to-date on the market and our work.

EU Pay Transparency Directive: What employers need to know

The EU Pay Transparency Directive introduces new rules requiring employers to provide greater transparency around pay, including salary ranges in job postings and reporting on gender pay gaps. It aims to reduce pay inequality across the European Union by giving employees clearer information and stronger rights to challenge unfair pay practices.

The new shape of in-house strategy and transformation teams: Lean central functions, expert flex and on-demand firepower

This article explores how in-house strategy and transformation teams are shifting from large, generalist functions to lean, senior cores supported by on-demand interim expertise.

Join our exclusive global community

Receive exclusive data & insights on pay, benchmarking, and industry interviews to build a career that’s right for you.

Create an account today and start searching roles in under five minutes.